Lay Tithes

FREE Catholic Classes

Under this heading must be distinguished (1) secular tithes, which subjects on crown-estates were obliged to pay to princes, or tenants, or vassals on leased lands or lands held in fief to their landlords ( decimæ origine laicales ), and (2) ecclesiastical tithes, which in the course of time became alienated from the Church to lay proprietors ( decimæ ex post laicales s. sæcularizatæ ). There is question here only of the latter. In the secularizations initiated under the Merovingians the transference of ecclesiastical property and their tithes or of the tithes alone to laymen was effected. In subsequent times church lands with their tithes, or the tithes alone, were bestowed even by bishops and abbots on laymen to secure servants, vassals, protectors against violence and defenders of their civil rights. Other church property with tithes, or the tithes alone, were forcibly seized by laymen. Finally, the development of churches, once the property of private individuals, into parish churches subject to the bishop gave rise to the landlord appropriating the tithes due to the parish church. The church soon took measures to repress this spoliation, beginning as early as the ninth century at the Synod of Diedenhofen (844; cap. iii, 5) and that of Beauvais (845; cap. iii, 6). Gregory VII revived in a stricter form these old canons at the Autumn Synod of 1078, demanding that the laity should return all tithes to the Church, even though they had been given them by bishops, kings, or other persons, and declared all who refused obedience to be sacrilegi (C. 1, C. XVI, q. 7). Succeeding popes and synods repeated this order, declaring that Church tithes to be iuris divini (C. 14, X, de decim., III, 30); that, as the inalienable source of income of the parish church, they could not be transferred to another church or monastery (C. 30, X, de decim., III,30); that they could not be acquired by a layman through prescription or inheritance, or otherwise alienated.

But it was quite impossible for the Church to recover the tithes possessed for centuries by laymen, to whom in fact they had been in many cases transferred by the Church itself. Laymen gave then, in preference to the monastery instead of the parish church, but this became thenceforth subject to the approval of the bishop (C. 3, X, do privil., III 33). The decision of the Lateran Council (1179), forbidding the alienation of the church tithes possessed by the laity, and demanding their return to the Church (C. 19, X. de decim., III, 30) was interpreted to mean that, those ecclesiastical tithes, which up to the time of this council were in possession of 1aymen, might be retained by them, but no further transference should take place (C. 25, X, de decim., III, 30, c. 2, A in Vito, h.t., III, 13). But even this cou1d not be carried out. There thus existed side by side with church tithes a quantity of lay tithes; the latter were dealt. with by secular courts as being purely secular rights, while ecclesiastical law was applied to ecclesiastical tithes. However, certain, of the obligations imposed by the (once) ecclesiastical tithes continued to bind the proprietor, even though he were a layman. Thus in the case of church buildings the Council of Trent declared that patrons and all "qui fructus aliquos ex dictis ecclesiis provenientes percipiunt" were bound secondarily to defray the cost of repair (Sess. XXI, De ref., c. vii; see FABRICA ECCLESLE). When there is a doubt as to whether the tithes in quetion are ecclesiatical or lay, the reasonable presumption is that they are ecclesiastical.

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

-

Mysteries of the Rosary

-

St. Faustina Kowalska

-

Litany of the Blessed Virgin Mary

-

Saint of the Day for Wednesday, Oct 4th, 2023

-

Popular Saints

-

St. Francis of Assisi

-

Bible

-

Female / Women Saints

-

7 Morning Prayers you need to get your day started with God

-

Litany of the Blessed Virgin Mary

Daily Catholic

Daily Readings for Sunday, November 24, 2024

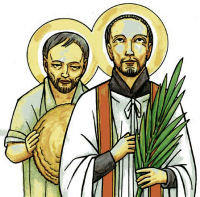

Daily Readings for Sunday, November 24, 2024 St. Andrew Dung Lac: Saint of the Day for Sunday, November 24, 2024

St. Andrew Dung Lac: Saint of the Day for Sunday, November 24, 2024 Prayer for Protection against Storms and Floods: Prayer of the Day for Sunday, November 24, 2024

Prayer for Protection against Storms and Floods: Prayer of the Day for Sunday, November 24, 2024- Daily Readings for Saturday, November 23, 2024

- Bl. Miguel Pro: Saint of the Day for Saturday, November 23, 2024

- Prayer of an Expectant Mother: Prayer of the Day for Saturday, November 23, 2024

![]()

Copyright 2024 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2024 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Sunday, November 24, 2024

Daily Readings for Sunday, November 24, 2024 St. Andrew Dung Lac: Saint of the Day for Sunday, November 24, 2024

St. Andrew Dung Lac: Saint of the Day for Sunday, November 24, 2024 Prayer for Protection against Storms and Floods: Prayer of the Day for Sunday, November 24, 2024

Prayer for Protection against Storms and Floods: Prayer of the Day for Sunday, November 24, 2024